Using payroll software to automate all or most aspects of payroll processes is highly beneficial whether your company is small, medium, or large. They help in managing employee payments by making it simple to direct your finances, manage payroll taxes, and keep track of your records to remain compliant.

If you’ve ever done payroll manually, you know how time-consuming it is and how easy it is to make mistakes. After all, each employee has a unique salary, leave balances, absences, and other considerations.

So, if you’re a New Zealand-based business, we looked at ten different NZ payroll software solutions to help you choose the best one for your needs.

Which Factors Should You Consider When Choosing Payroll Software?

When deciding on the best payroll software for your business, you should consider the size of your company, your payroll budget, the benefits you provide, and so on.

You’ll be in a better position to choose the right software for your company if you have a clear understanding of what it has.

As a result, when reviewing and selecting the best NZ payroll software, we focused on the following factors:

- Pricing: Each software has a different pricing structure that provides different benefits. Moreover, note that most of the prices discussed here don’t include GST.

- Compliance: Good payroll software will help you stay compliant with New Zealand’s various legislations.

- Usability: Your payroll software must be user-friendly and, preferably, have a modern user interface. Additionally, offering a convenient mobile experience is a major plus.

- Features: Every payroll software has different features that you may or may not need. So, it’s worth going through them in your selection.

- Customer Support: One of the most important factors to consider is support, which allows you to get the assistance you need when you encounter problems with your Payroll software.

So without further ado, here are the best payroll software in NZ:

1 – PayHero

FlexiTime’s PayHero offers a series of features for managing payroll, with HR thrown in for good measure. It was created with the goal of being user-friendly, feature-rich, and compliant. You can pay your employees manually or automatically with it.

The software tracks your team’s leave, hours, and holidays automatically using GPS and other tools. You can then use the records to keep you compliant and generate payroll. Your employees can also use the dedicated mobile app to submit their hours, leave requests, and other information.

The PayHero software complies with the MBIE Holidays Act guidance, and every legislative update applies automatically without the need for manual intervention. Moreover, the software comes with the support of a dedicated NZ team.

PayHero offers a 14-day free trial period, after which you can choose from three different plans. The base fee for the origin package is $19, plus $4 per employee per month. The super plan has a $39 monthly account fee plus $5 per employee per month. The last plan begins at $59 plus $6 per employee per month.

2 – iPayroll

iPayroll has plans for businesses of all sizes, from small and medium-sized to enterprises and governments. It includes full-service automated payroll that can be tailored to almost any business’s needs, as well as human resources (HR) features. Additionally, it allows your employees to log in, view their payslips and tax summaries, record working hours, apply for leave, and even donate to charities.

iPayroll, like other payroll software solutions, provides direct deposit to pay your employees. It also has a comprehensive reporting feature that covers financial, HR, leave, history, payroll, and taxes, which can be viewed or downloaded online. Moreover, iPayroll integrates with many accounting, attendance, and HR systems for data exchange.

iPayroll ensures IRD, Payday filing, KiwiSaver, and Employee Share Scheme compliance. The plans start at $35.35, but they are highly customizable to your specific needs. You can also request a free demo.

The iPayroll team will help you in configuring the software, as well as provide training. Subsequently, they offer ongoing free support.

3 – Crystal Payroll

Crystal Payroll provides a comprehensive set of cloud-based payroll features for businesses of all sizes, from small to large. It also ensures full IRD compliance through automatic Payday Filing. In addition, you can view PAYE records on a single, user-friendly dashboard. And when you need it, you can reach their customer service by phone or email.

Crystal Payroll generates a wide range of reports, ranging from employee and company reports to accounting and contractor reports. It is also compatible with major accounting, time management, and banking systems.

The payroll software makes it simple to set up multiple pay cycles. It allows you to pay hourly or salaried employees at various rates. Besides, you can control how employees get paid and easily calculate holiday pay and leave. Crystal Payroll also provides add-ons to further streamline and improve payroll processes.

Crystal Payroll’s plans begin at $19.90 per month, plus $50 for registration and $60 for a phone-based training session. They provide four different plans from which to choose, and you can request a free demo to test-drive the software.

4 – MYOB IMS Payroll

MYOB IMS Payroll is another cloud-based payroll software that is designed to grow with your company. It provides dedicated customer support and seamless integration with third-party software.

This payroll software allows you to track and manage all aspects of payroll, from setting up payments, deductions, and pay points to tracking leave, history, and personnel details. And, while all the information is easily accessible, the interface can feel a little dated.

IMS provides employee self-service, allowing your staff to quickly access their payslips, apply for leave, update their information, and much more. You can also generate detailed HR, employee data, Payroll, and IRD reports.

Finally, companies can choose between two IMS Payroll plans based on their size. Essentials Payroll starts at $30 per month and supports up to ten employees, and it is accessible from any device. The ACE Payroll costs $379 and is only available on desktops for businesses with 10 or more employees. They also provide accounting and payroll plans for small businesses for $60 per month.

5 – Xero

Xero payroll software allows you to automate and track online payroll data such as tax, superannuation, and leave. It also helps in IRD compliance by automatically filing payday on each pay run, while allowing you to view filing history and amend the information at a glance. In addition, you can enjoy 24/7 online support.

Xero, like many of the other payroll software on this list, offers employee self-service. You can save time on administrative tasks by allowing your employees to submit requests and timesheets, as well as view their leave balance and payslips.

This software allows you to generate and view a variety of payroll reports to obtain detailed information on payroll activities, transactions, leave balances, timesheets, and much more.

You can try out all of Xero’s features for free for 30 days before deciding on the plan that best suits your needs. Following the free trial, you can choose between the starter package for $29, the standard package for $62, and the premium package for $78. Each package includes optional add-ons that can be selected to enhance the experience.

6 – SmartPayroll

SmartPayroll makes it simple to stay compliant and pay employees by offering automated payments to employees, KiwiSaver, PAYE, IRD, and payday filing. They provide free training, initial setup, and support.

SmartPayroll has a mobile app that allows you to manage your payroll while on the go. Additionally, it has an app for your employees to record their time, request leave, and enter their information.

The software can be tailored to various industries, ranging from retail to manufacturing and everything in between. It also has a direct deposit feature, allowing you to pay your employees directly from the software.

You can also use the Project Costing feature. It allows you to keep track of project hours and labour costs. And it can be customized by project, region, or department.

SmartPayroll offers a free 30-day trial, after which pricing is determined by factors such as employee count, pay cycle, and others. However, all plans include free automatic backups, feature updates, and access to customer support.

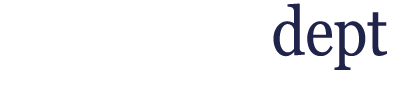

7 – PaySauce Payroll

PaySauce is an online payroll software that assists you in paying your employees and taxes. It also calculates wages, PAYE, KiwiSaver, and files payroll compliance paperwork with the IRD.

The software supports a variety of platforms, including mobile and desktop, allowing you to manage your payroll from anywhere. It integrates with banks, Inland Revenue, and Xero directly.

The Rosters solution is one of PaySauce’s best features. It is intended to be a user-friendly module with an easy-to-use calendar view. You can personalize shifts, add notes, and select how your team is notified. In the calendar view, it also displays your employee’s approved and pending leave requests.

An in-house team provides phone and email support. Finally, PaySauce has three plans to choose from: Simple, Standard, and Premium. The basic plan costs $11 and lacks phone support, automated banking, and other features. The standard plan costs $35 and does not include custom costings or branded payslips. The premium plan costs $56 and includes everything, as well as the Rosters module.

8 – SmoothPay

SmoothPay’s goPayroll is a user-friendly and simple online payroll software that allows you to automate payroll reporting. It integrates with accounting systems like MYOB, Xero, and Reckon.

The software also includes self-service features that allow your employees to track their attendance, view their salary history, and request leave. They provide training and product support via TeamViewer. Even during the free trial period, they provide it.

SmoothPay is one of the few softwares in New Zealand that offers full compliance with Holidays and Parental Leave legislation. In addition, it offers automatic Payday Reporting and Single Touch Payroll.

SmoothPay offers a free 30-day trial period that includes training and migration assistance. You can then select the best plan for your company from two options: monthly or annual subscriptions. The monthly plan starts at $35, while the annual plan starts at $365.

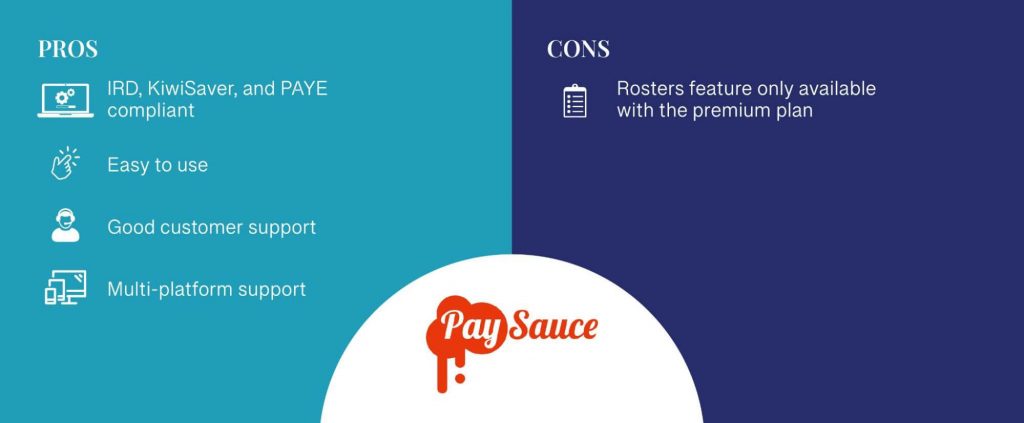

9 – Your Payroll

Your payroll is intended to accommodate businesses of all sizes. It is a free web-based payroll processing and people management software solution that is Kiwi-owned and operated.

The software enables you to easily confirm salaries and pay employees. It also computes PAYE, KiwiSaver, Student Loans, Annual Leave, Sick Leave, Alternative Holidays, and other benefits. It even files return to IRD.

Your Payroll allows you to review pay run details on a daily, weekly, or monthly basis. It also provides direct deposit and automated payslips.

You can use Your Payroll to pay up to 50 employees for free, as well as features like payday filing, payslips, and leave management. However, if your company employs more than 50 people, you pay $2.99 per person, along with all the features of the free version, as well as customizable payment options and employment contacts.

10 – KeyPay

KeyPay is a cloud-based payroll software that automates manual processes and aids in NZ legislation compliance. It complies with the Holidays Act, Payday Filing, PAYE, and KiwiSaver requirements.

The software simplifies timesheet management, leave, and other payroll processes through employee self-service features. Employers can also easily approve requests and submit data using the web or mobile apps.

KeyPay also helps with tax and GST calculations, as well as any other information included in the pay run and payslips.

The fully functional KeyPay payroll software includes a free trial with any plan purchased. KeyPay Standard costs $4 per month per active employee, and KeyPay Plus costs $6 per month per active employee. Each plan includes a variety of features.

Payroll Software vs. Outsourcing

When it comes to payroll, you have the option of doing it manually or using modern payroll software packages. You can also outsource all of your financial tasks to a payroll service.

Payroll Software

Payroll software allows for easy remote access from anywhere, as long as you have a phone or laptop. They can also be customized and adjusted to reflect policy changes. And, once you’ve mastered the software’s intricacies, they can make payroll much easier.

Payroll software packages, on the other hand, have drawbacks. For starters, they can be difficult to learn, especially if the vendor does not provide training. And, while they automate the majority of processes, human error remains an issue. That’s because the majority of the initial data is submitted by you or your employees. Finally, the convenience that payroll software brings usually comes with a high price tag. This is especially true when you’re paying for features you don’t need.

Outsourcing Payroll

Third-party companies will handle all aspects of payroll if you want a hands-off payroll operation. Their services range from managing contractors to ensuring that all of your employees are paid correctly and on time.

One of the most appealing aspects of outsourcing payroll is that you only pay for the services you need. Pricing and solutions are always tailored to your needs and the size of your business. You’ll also get excellent customer service and prompt communication because you’re dealing with people directly. Finally, outsourcing will allow you to free your mind from payroll management and focus on other aspects of your business.

However, when you outsource, you may find it difficult to gain immediate access to your data. This is because much of the payroll is kept off-site. Even when cloud connections are used, data may be restricted for security reasons.

About Accountsdept’s Payroll Outsourcing Services

With over 8 years of experience, Accountsdept has worked with a wide variety of New Zealand businesses. As a result, we understand how much work you have to do when running your business. That’s why we’re here to take care of all payroll processes for you, efficiently, quickly, and with painstaking attention to detail so that you don’t have to. Not only that, but we can also train your team if that is what you need.

Accounttsdept will give you peace of mind and transform your business, regardless of the type of company you have. We’re here to help you save time, money, and reduce stress.