It goes without saying that money and finances are important aspects of one’s life that must be managed properly. If, on the other hand, you are stuck on how to go about it, here is a straightforward, four-step guide to getting your finances in order.

01.Build an emergency fund in the first place.

The first step in putting together an emergency fund is determining how much protection you want to provide. It’s a good idea to have at least three months’ worth of living expenses saved in an emergency account, and six months’ worth of living expenses is even better.

I can’t even imagine pulling something like that off. Stop concentrating on the big picture end goal. The goal here is to create an automated mechanism that automatically deposits money into your emergency fund on a monthly basis.

The most straightforward method of accomplishing this is to open a separate bank account that will serve solely as an emergency fund. This money should be kept separate from other funds in your regular checking account. (Keeping the money in your regular checking account creates the temptation to use the money for non-emergencies.)

02-Develop a financial plan

A budget is a detailed accounting of all of your revenue and all of your expenses, done line by line. The entire purpose of creating a budget is to lay everything out in front of you so that you can see where your money is going and make adjustments if you aren’t on track to meet your saving goals.

Let’s put together a personal budget in a few simple steps.

Create an estimate of your monthly earnings, select a budgeting strategy, and keep track of your progress. The 50/30/20 rule can be used as a starting point for budgeting. It is recommended that you set aside as much as 50 percent of your income for essentials. Allow for 30 percent of your income to be spent on wants and impulse purchases. With 20 percent of your income, you can put money aside and pay down debt.

03-Start putting money aside for retirement savings.

Although there is no single formula for determining how much money you’ll need, a good rule of thumb is to set aside a multiple of your pay at various ages throughout your career. The chart below shows that having two times your salary in your retirement account by the age of 35 puts you in a strong position to succeed in retirement. Save six times your annual salary by the time you’re 50, and ten times your annual salary by the time you’re in your mid- to late-sixties.

04.Pay the bare minimum of your credit card

If you only pay the minimum balance due on your credit card, it will take much longer to pay off your debt. If you pay more than the bare minimum, you will end up paying less interest in the long run. If you ask for information about your account, your credit card issuer is required to provide it so you can understand how it affects your charge. Do you owe money on a number of different credit cards? Make certain that you always pay the bare minimum on each of your credit cards if this is the case. Then concentrate on paying off the total balance of one credit card at a time.

Financial planning in your 30s

Know where you are – The first step toward financial planning in your 30s is to establish a baseline for where you are now and where you wish to be in the future. You need to see how much money you have coming in, where it’s going, and how much do you keep each week, month, or year?

Establish a financial plan – Create a budget, if you do not have one already. The purpose of creating a budget is dual. To begin, it provides insight into how you spend your money at the moment. Second, it will assist you in making decisions regarding how you spend your money on the things that are most important to you now and in the future.

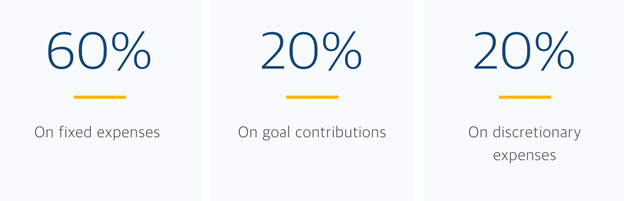

When you create a budget, you are attempting to gain visibility into your income. To begin, add together your monthly take-home pay from all sources of revenue. Then, total your monthly expenses and organise them as follows:

01. Fixed expenses

Your fixed expenses will include anything that you must pay on a recurring basis. These will almost certainly be expenses that are necessary for your daily life. This may include your mortgage/rent, utilities, phone, internet/cable bill, and automobile/home insurance.

02.Contributions to financial goals

This is money set aside for financial objectives. This category may include savings for a down payment on a home, retirement, or college, as well as additional debt payments. Additionally, it includes any finances you are contributing to an emergency savings or health care premiums (life insurance).

03. Discretionary expenses

Discretionary expenses are basically everything else. This is your “fun money” and will often include things like entertainment, splurges, eating out or going on vacation. Most likely, it will be the category where you have the most flexibility to free up money in your budget.

Consider your objectives for the decade following your 30s- Invest in yourself – After establishing the necessary safeguards to safeguard your financial plan, it’s time to begin growing your wealth. This may involve a combination of debt repayment and saving and investing for various goals, depending on your financial situation.

Establish an estate plan – Many people believe that estate planning is something that only wealthy people do. In reality, an estate policy outlines what will happen to your loved ones if you die, who will be able to make medical and financial decisions on your behalf, and how you want any money you leave behind to be used.

While it is unpleasant to consider, it is a necessary component of financial planning. If you don’t already have an estate plan in place, your 30s are a critical time to do so.

Enjoy your money – Many people believe that financial planning is all about making sacrifices today to save for the future. This is not the case. Financial planning, in reality, is about prioritising what is truly important to you and devising a strategy to achieve it. It actually assists in allowing you to spend your money today without feeling guilty about sacrificing a future goal.

If you haven’t already begun developing a financial plan, there is no better time than now. If you do have a plan, revisit it to ensure that it remains focused on your 30s goals. A financial advisor can assist you in developing or updating your financial plan. When you reach your 30s, the following are some questions to discuss with your financial advisor.

Free Financial advice NZ

A financial planner can assist you face-to-face with your family and personal funds (sometimes known as a budget advisor).

“Accountsdept” can assist you in the following ways:

- managing your urgent financial hardships and to create a financial plan.

- assist you in developing a Financial Plan of Action to guide you in achieving your goals

- haggle for reduced payments

- Identify more individuals that may be able to assist.

Advantages of financial planning

Here are a few benefits of financial planning:

- Financial planning helps you set and achieve your financial goals.

- Having a financial plan is a source of motivation and commitment.

- It provides a guide for action planning and decision making.

- It provides additional emotional and mental health benefits

- Having a plan can help you set performance standards for yourself.

- It improves your overall financial outcomes.